기사본문

‘Turning point’ of ABL, T cell engager is “the reason to be confident”

입력 2022-02-18 10:00 수정 2022-02-18 10:00

by Sungmin Kim

The key message of ABL Bio's $1.06 billion "Big Deal" with a $75 million deposit with Sanofi alone is that it has taken the first step in showing its solid presence as a bispecific antibody (BSAb) company in the global industry. In the meantime, the industry's eyes are naturally heading to the bispecific antibody platform that ABL Bio has been building.

Another notable point is that the recent movement of bispecific antibodies in the global market is unusual. Following active deals, approvals are continuing. This year alone, important milestones followed. Last month, Immunocore received approval of the first TCR bispecific antibody as a solid cancer treatment, and Roche received the first bispecific antibody treatment approval in ophthalmic disease. In addition, following CD19, the release of CD3 bispecific antibodies targeting BCMA is also expected. The bispecific antibody is gradually becoming a mainstream treatment modality by expanding the disease.

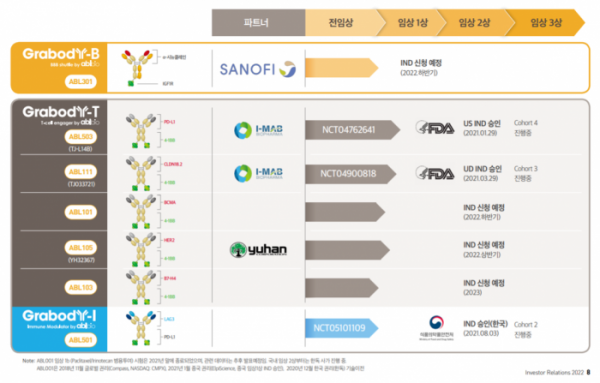

Amid this movement, ABL Bio, which has advocated a bispecific antibody platform company, is taking an aggressive step different from before. If we can express the company’s changed appearance starting in 2021 in one word, it is now a transition to a biotech platform in the ‘clinical development’ stage. This is also confirmed by actual numbers. In last year alone, there are only three candidate substances for immuno-oncology drugs that ABL Bio discovered and went into clinical trials. Two bispecific antibody immuno-oncology candidates based on the 4-1BB platform are undergoing clinical trials in the US, and one bispecific antibody candidate that simultaneously targets PD-L1 and LAG-3 immune checkpoint inhibitors is undergoing domestic clinical trials in Korea. As a company, it is building a solid foundation in the field of immuno-oncology by communicating with regulatory authorities.

What’s surprising is that this year’s momentum will accelerate further. There are 3 cases of IND submission that the company is planning this year. ABL Bio plans to file an IND application with the US Food and Drug Administration (FDA) for two new 4-1BB bispecific antibodies, and the blood-brain barrier (BBB) penetrating bispecific antibody licensed out to Sanofi is also planned to be submitted INDs for US clinical trials in September. ABL Bio has already unveiled an additional 4-1BB program that will begin clinical trials next year, and has also begun presentations at conferences on the next-generation CD3 bispecific antibody beyond the existing platform.

Six bispecific antibody candidates entered clinical trials in two years last year and this year. This is also faster than global antibody platform companies. It seems that the basis for ABL Bio's betting on clinical development as a domestic bispecific antibody platform company was its confidence in the platform's competitive advantage and willingness to prove the platform with clinical data.

Sang Hoon Lee, CEO of ABL Bio, said, "This deal with Sanofi is a starting point for ABL Bio to look forward to the next decade and walk to grow as a global platform company. Now, technology transfer has made it possible to move beyond survival to the next level. Based on the discussions so far, we expect a good partnership not only with BBB-penetrating antibodies but also with the immuno-cancer drug bispecific antibody platform this year. And ABL Bio aims to submit INDs for two to three bispecific antibody candidates every year."

Currently, the technology that occupies a large portion of the ABL Bio project is the ‘Grabody-T’ platform, a T-cell engager based on the 4-1BB bispecific antibody. ABL Bio is confident in the ‘best-in-class’ of the 4-1BB bispecific antibody, and is setting up a strategy for positioning each project in a competitive environment. It is also a part that can become a deal point in the future. In response, Biospectator reviewed ▲the differentiation of the 4-1BB project in the clinical development stage and milestones to watch out for ▲follow-up projects scheduled for clinical development for this and next year ▲ development direction of the next-generation immuno-oncology.

Meanwhile, ABL Bio has secured KRW 57 billion of funds (as of January 1, 2022), and is expected to receive an additional KRW 144 billion this year according to a license out deal with Sanofi. In addition, it is expected to secure approximately KRW 211 billion in funds this year as it is expected to receive approximately KRW 10 billion in milestones from existing partnership deals.

◆ABL 4-1BB bispecific antibody, ‘best-in-class’ as a T cell engager

Currently, one of the key issues in the global immuno-oncology field is how to limit immune activity to the tumor site.

Looking at the recent development flow, CD3 bispecific antibody that activates T cells has elicited a high response rate in blood cancer patients, but it still fails to solve the systemic toxic adverse effects, causing disruptions in development. In fact, if you look at the deals signed by global companies such as Amgen, Sanofi, Merck (MSD), and Takeda in the past year, all of them are focused on acquiring CD3 bispecific antibody technology with a prodrug concept that activates tumor specific T cells. In addition, the flow of immune-activating drugs such as IL-2, IL-15, and IL-12 cytokine drugs or TLR 7/8 and STING that activate immunity is also focused on the keywords of tumor-specific activation and delivery. These technologies are in their early stages, and no clear results have been achieved in clinical practice yet.

ABL Bio is betting on the 4-1BB target. 4-1BB belongs to the TNF receptor superfamily that regulates activation, proliferation, and survival by expressing on the surface of cytotoxic T cells and NK cells. 4-1BB has proven efficacy in clinical trials, but in the case of monoclonal antibodies that activate it, it is a difficult target to develop alone due to FcγR receptor-mediated hyperclustering and ‘on-target’ hepatotoxic side effects. In the case of ‘urelumab’ from BMS as a representative 4-1BB agonistic antibody, the maximum tolerated dose (MTD) that can be administered to a patient in clinical practice is very limited at 0.1 mg/kg.

Therefore, if 4-1BB is activated only at the tumor site in the bispecific antibody format, it is a strategic approach that will be competitive if a sufficient effective dose can be administered while lowering the hepatotoxic side effect. The 4-1BB bispecific antibody binds to the tumor-associated antigen (TAA) overexpressed in the tumor microenvironment and 4-1BB expressed by T cells, and as a result, it will activate T cells to kill cancer cells. This is why the 4-1BB bispecific antibody belongs to the T cell engager.

In this respect, it is evaluated that ABL Bio's Grabody-T is the most optimized technology for this T cell engagement concept compared to the global competitor's 4-1BB bispecific antibody. CEO Lee explained, “The difference between ABL Bio’s GrabBody-T compared to competitors is that 4-1BB itself does not show activity, but only shows activity when it has a bispecific antibody format.” In addition, ABL Bio designed to eliminate the Fc function (ADCC, CDC) of the 4-1BB bispecific antibody and minimize FcγR-mediated clustering.

This distinction is clearly shown in the data. According to the data presented by ABL Bio at the American Association for Cancer Research (AACR) 2021, the monoclonal antibody (1A10) to which the 4-1BB sequence of GrabBody-T is applied does not show activity by itself; the Fc part of the antibody showed weak activity when the 4-1BB cluster was induced by cross-linking. For reference, it is important to note that 4-1BB is activated while forming a trimer to form a cluster. In the bispecific antibody format, strong 4-1BB activity was elicited, which was dependent on the level of tumor-associated antigen (TAA) expression. On the other hand, 4-1BB signaling was activated to a similar degree regardless of the expression level of the urelumab’s expression of tumor antigen.

Then, why does Grabody-T show such unique characteristics? This can be explained in terms of epitope and bispecific antibody format.

First, looking at the epitope part, ABL Bio discovered a new sequence through phage library screening and biological activities such as 4-1BB binding and activation, and found that it binds to CRD4 of 4-1BB through epitope mapping. 4-1BB consists of four domains, CRD1 to CRD4. At this time, CRD4 is located close to the cell membrane, and in the case of urelumab, which has shown strong toxicity in clinical practice, it binds to CRD1. These epitope differences may lead to differences in the mechanism of action. Although the 4-1BB sequence of ABL Bio is not activated alone, urelumab alone induces strong activity, which leads to ‘on-target’ side effects in liver tissue. In addition, CRD4 has the advantage that it does not compete with the 4-1BB ligand (4-1BBL; CRD2~3 binding) in the body.

In a similar approach, Agenus is developing 'AGEN2373', a 4-1BB monoclonal antibody that targets CRD4, and the company explains that AGEN2373 is conditionally activated only in situations where 4-1BB becomes a cluster, unlike urelumab. It is explained that based on these characteristics, Agenus is developing the 4-1BB antibody AGEN2373 with Fcγ function. The unique drug mechanism led to the signing of an option deal with Gilead. Agenus presented its first clinical results at the American Society of Clinical Oncology (ASCO) last year, and no dose-limiting toxicity (DLT) or hepatotoxicity was observed up to a dose of 3 mg/kg (administered once every 4 weeks). In the case of a competitor's bispecific antibody, the administration dose is limited due to 4-1BB toxicity, which can be interpreted positively for ABL Bio.

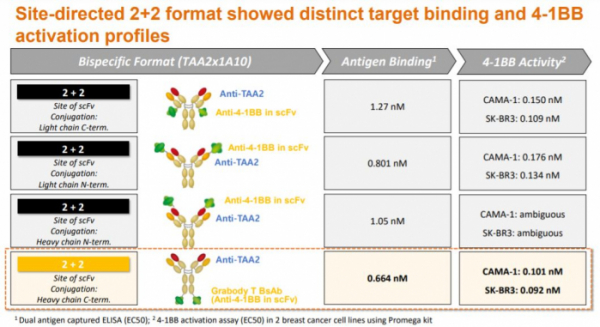

Next is the bispecific antibody format part. First, Grabody-T has a ‘2+2’ structure and is a form in which 4-1BB scFv is attached to the Fc portion of a tumor-targeting (TAA) antibody. This form has a higher avidity than the format with one 4-1BB binding site, so that the formation of 4-1BB clusters can be more easily induced in the tumor microenvironment. Also, there is an advantage in terms of immune synapse, the length between 4-1BB and 4-1BBL is 13.4 nm, and the entire GrabBody-T format has a similar 15 nm. In fact, when the ABL Bio research team tested various ‘2+2’ formats, the current form proved to have the highest 4-1BB activation efficacy.

Competitors Genmab and Merus have a '1+1' form, and Pieris Pharmaceuticals' has '2+2' form. There is also a difference in the composition of the portfolio according to these formats. In the case of Genmab and Merus, candidate substances that target both immune checkpoint molecules (PD-L1, OX40) and 4-1BB are being developed, and Pieris is developing T cell engager portfolio, targeting a wider range of tumor-associated antigens (HER2, PD-L1, GPC3).

◆ Positioning of 4-1BB bispecific antibody on clinical development

①ABL503: PD-L1x4-1BB

ABL503 is the most advanced project among 4-1BB bispecific antibodies, and it is also the bispecific antibody that ABL Bio first started clinical trials in the US.

ABL503 is a PD-L1x4-1BB bispecific antibody. It is different from other projects in that it targets the immune checkpoint molecule PD-L1. The resulting mechanism can be understood in two ways. First, it can activate T cells specifically for PD-L1 expressed by cancer cells in the tumor microenvironment, and the activation efficacy of 4-1BB was higher than that of urelumab when PD-L1 expression was high.

Next, ABL503 is expected to enhance anticancer efficacy by activating 4-1BB, a co-stimulatory factor, in T cells while inhibiting PD-L1/1 signaling. In particular, 4-1BB is highly expressed in CD8+ tumor infiltrating lymphocytes (TIL), which is known to have high PD-1 expression, and it was confirmed that the function of T cells was restored again when ABL503 was administered in preclinical studies (doi: 10.1136/jitc-2021-) 002428).

Competition for development over PD-L1x4-1BB bispecific antibody is fierce, and there is ‘GEN1046’, co-developed by Genmab and BioNTech, companies that have published clinical data so far. Genmab announced the results of the first phase 1/2 clinical trial of GEN1046 at the American Society for Immunotherapy of Cancer (SITC) last year. Genmab is undergoing phase 1/2a clinical trials in patients with advanced solid cancer who have been administered PD-(L)1 inhibitors and have relapsed or who have failed to respond. Its response was divided based on PD-L1 expression, and drug reactions were observed in PD-L1 (+) patients. Also, the responses of peripheral immune mediators such as CD8+ Tem cells and NK cells were different according to drug administration. These data show that the PD-L1x4-1BB bispecific antibody works according to the expected mechanism.

The GEN1046 dose escalation cohort started at 25 mg and was administered up to 1200 mg, and the expansion cohort was dosed at 100 mg. According to the drug safety data updated by BioNTech last month, dose-limiting toxicity (DLT) was observed in six patients, and the maximum tolerated dose (MTD) had not yet been reached.

Regarding the point of differentiation in the future, CEO Lee said, “Even in preclinical results conducted by ourselves, ABL503 is expected to show drug efficacy when PD-L1 is expressed. If we secure a wider therapeutic window than Genmab in the AL 503, we believe that it can have competitiveness as a 'best-in-class' drug. In the clinical cohort that has been conducted so far, there have been no grade 3 or higher adverse effects.”

ABL Bio started the US phase 1 clinical trial of ABL503 for solid cancer patients in April last year and is currently administering cohort 4 dosing. The phase 1 clinical trial is conducted to determine the maximum tolerated dose (MTD) and the recommended phase 2 clinical dose (RP2D). It is expected to be completed in the middle of next year and the top line results will be announced (NCT04762641).

②ABL111: CLDN18.2x4-1BB

ABLBio's ABL111 is the only bispecific antibody that simultaneously targets 4-1BB and CDLN18.2, and is in the clinical development stage with potential as a 'first-in-class' drug.

Claudin 18.2 (Claudin18.2, CDLN18.2) has recently been attracting attention as an attractive target as positive results have been obtained in solid tumors. Claudin 18.2 is a tight junction cell membrane protein that originally connects in between the cells. And in normal tissues, it is expressed in the gastric mucosa, so the antibody cannot reach it. However, it is expressed in a form that can be recognized outside the cell in tumor tissues, and is particularly highly expressed in solid cancer tissues such as gastric cancer, pancreatic cancer, esophageal cancer and lung cancer. In normal tissues, it is limited only to the gastric mucosa and is actively being developed as a target for immuno-oncology drugs because of its high expression in cancer tissues.

Based on these advantages, development is being attempted with various treatment modality. As a leading company, Astellas is conducting phase 3 clinical trials for gastric cancer and phase 2 clinical trials for pancreatic cancer of 'zolbetuximab', a CLDN18.2 monoclonal antibody, and CARsgen Therapeutics and Legend Biotech (China) Legend Biotech) is developing CDLN18.2 CAR-T, Amgen is developing CDLN18.2xCD3 bispecific antibody and other forms such as ADC.

Significant clinical data are also being derived. Astellas derived the result of extending the survival period (OS) of patients in the phase 2 clinical trial of zolbetuximab. Astellas showed that the combination of zolbetuximab and chemotherapy (EOX) was administered to a patient with gastroesophageal junction cancer (GEJ) expressing CLDN18.2 in a phase 2 clinical trial last year, and as a result, progression-free survival (PFS) was improved and overall survival (OS) was increased compared to the control group. However, only the case of high expression of CLDN18.2 (over 70%, based on IHC) showed an advantage, and there was no benefit in patients with a lower expression of 40~69%.

Based on these results, Astellas is conducting a phase 3 clinical trial comparing zolbetuximab chemotherapy combination in HER2-negative gastric cancer and GEJ patients expressing CLDN18.2 75% or more. According to the company, patients who meet the criteria were about 30 to 35 percent of the total.

CARsgene also presented its first clinical results at the European Society for Medical Oncology (ESMO) last year. CARsgene is conducting the CLDN18.2 CAR-T clinical trial for CLDN18.2 expressing (≥+, ≥10%) gastric cancer and GEJ patients. Positive initial results were confirmed, with a response rate (ORR) of 61.6% and a disease control rate (DCR) of 83.3% in 18 patients who received the RP2D dose (2.5X10^8). According to CARsgene, about 60% of gastric cancer and GEJ patients have moderate to high expression of CLDN18.2.

There are patients who failed after receiving two or more previous treatments, and it is meaningful data in that about 40% of them had a high response rate even though they had received PD-(L)1 before. In addition, there were no reports of grade 3 or higher cytokine release syndrome (CRS) or neurotoxicity, confirming its potential as a target for CAR-T solid cancer.

Accordingly, the development of an ‘off-the-shelf’ type of bispecific antibody beyond customized treatment is also expected. Among them, Amgen’s CDLN18.2xCD3 bispecific antibody ‘AMG 910’ is the leading drug. However, AMG 910 applied the Amgen’s BiTE platform which increases half-life of drug, and it seems necessary to develop a CD3 drug with improved safety in that about half of the entire portfolio was stopped due to the toxic adverse effect of BiTE in clinical trials. There is no T-cell engager that has shown significant clinical efficacy yet.

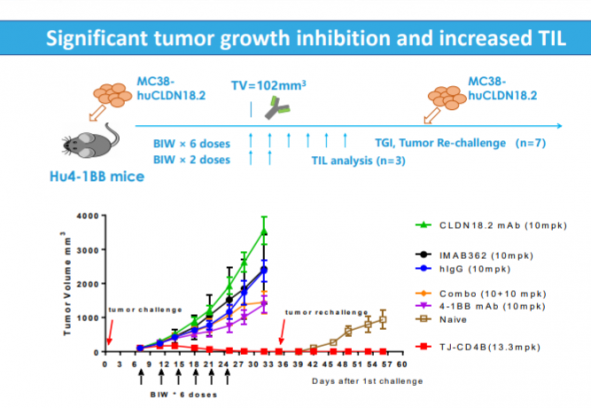

In this regard, the clinical results of ‘first-in-class’ ABL111 are looking forward to. There are three differentiating points of ABL111 that ABL Bio saw in preclinical studies. First, CLDN18.2 of ABL111 showed higher avidity than the competing antibody, and showed efficacy in cell lines expressing low CLDN18.2. Second, it was confirmed that ABL111 activates 4-1BB and T cells according to the CLDN18.2 expression level. Finally, in the rechallenge model, where tumors are re-injected with data differentiated from competing drugs, the ABL111-administered group confirmed the long-term memory formation efficacy as the tumor did not grow unlike the control group and the TIL penetration in the tumor was also increased.

ABL Bio’s joint development partner, China’s I-Mab, is leading the clinical development. In June of last year, the US phase 1 clinical trial of ABL111 started for a total of 108 patients with advanced solid cancer, and will end in March, 2024 (NCT04900818).

③ Follow-up of 4-1BB bispecific antibody.. Attention to T cell engager ‘combination strategy’

It is expected that two additional 4-1BB bispecific antibody assets will begin clinical development this year. ABL Bio is planning to apply for an IND in the US for ‘ABL101’, a BCMAx4-1BB bispecific antibody targeting multiple myeloma (MM) in the second half of the year. Its partner, Yuhan Corporation, plans to submit an IND for the HER2x4-1BB bispecific antibody ‘ABL105’ for HER2 solid cancer in the first half of the year.

Next, ABL Bio first unveiled the B7-H4x4-1BB bispecific antibody ‘ABL103’ at the PEGS Europe conference last year, and is developing it at a speed with the goal of ‘first-in-class’. ABL Bio is planning to submit an IND for ABL103 in the third quarter of next year.

B7-H4 is a membrane protein belonging to the B7 family and inhibits T cell growth, cytokine secretion, and anti-tumor activity, and is overexpressed in triple-negative breast cancer (TNBC), ovarian cancer, and non-small cell lung cancer, resulting in poor prognosis. Based on these characteristics, ABL103 has a mechanism of action to revive T cell activity by targeting immunosuppressive B7-H4 while activating T cells in tumors expressing B7-H4.

ABL Bio confirmed that ABL103 selectively binds to B7-H4 (Ig-like V domain binding) but does not bind to other B7 families. Also, in preclinical studies, ABL103 restored B7-H4-mediated T cell inhibition, which was at a level similar to that of the competitor's B7-H4 antibody. In addition, ABL103 activated 4-1BB signaling in a B7-H4 expression-dependent manner and induced long-term memory in a mouse tumor model.

In the future, the positioning of the 4-1BB bispecific antibody in the field of T-cell engagers is expected to be further expanded. It is a strategy of co-administration of a 4-1BB bispecific antibody to a CD3 bispecific antibody.

Roche Genentech, a leader in CD3 bispecific antibodies, has been testing a strategy of co-administering the company's T-cell bispecific (TCB) candidate with 4-1BB bispecific antibody, and CD19/4-1BBL and CD20-TCB to increase drug response. Roche is in the process of developing phase 1 clinical trials for two drugs, CD19/4-1BB and FAP/4-1BB, targeting blood cancer and solid cancer, respectively. Another company, Amgen, purchased a preclinical FAPx4-1BB drug (AMG 506) from Molecular Partners for co-administration with its CD3 bispecific antibody. FAP is a factor that is highly expressed in stroma of several solid cancers and is undergoing phase 1 clinical trials.

In a similar approach, we should look at the strategy of co-administration of CD3 bispecific antibody and CD28 bispecific antibody. CD28 is a costimulatory that is turned on after T-cell CD3 signaling is activated and increases T-cell activation and proliferation. CD28 is a super agonist, and it is a target that cannot be developed by single administration due to adverse effects. Therefore, it is being developed in the form of a bispecific antibody that is activated specifically for tumors.

Last year, Janssen signed a research agreement on a novel B-cell-targeting CD28 bispecific antibody by purchasing 'plamotamab', a CD20xCD3 bispecific antibody from Xencor. Also, a year earlier, Janssen purchased the CD28 bispecific antibody from Xencor for a co-administration strategy targeting prostate cancer. Additionally, Regeneron is aggressively increasing its CD28 bispecific antibody portfolio for co-administration with its own CD3 assets, and CD28 bispecific antibodies targeting PSMA, MUC16, and EGFR, respectively, are in phase 1 clinical trials. In addition, Sanofi is conducting clinical development of a CD3xCD28 triple antibody that targets HER2 and CD38, respectively.

CEO Lee said, “The current trend in the T-cell engager field is divided into three major categories: the CD3 bispecific antibody, the 4-1BB bispecific antibody, and the CD28 bispecific antibody. The most actively developed CD3 bispecific antibody has side effects in clinical practice, so next-generation drugs are being developed, and strategies for co-administration of 4-1BB or CD28 bispecific antibody are being attempted while reducing the CD3 bispecific antibody dose. 4-1BB does not elicit a strong T-cell response as instantaneously as CD3, but it has the advantage of forming long-term memories and lowering relapse.”

In fact, both CD28 and 4-1BB are factors used in the costimulatory domain of CAR-T. In clinical practice, differences were observed in the in vivo pharmacokinetic (PK) properties of CAR-T using each costimulatory factor. While CD28 is initially focused on eliciting faster and stronger responses, 4-1BB has the advantage of inducing long-term memory. Recently, there is a trend to use 4-1BB more in consideration of the relapse and persistence of CAR-T cells in the body.

◆ABL501: Development strategy of LAG-3 bispecific antibodies

LAG-3 is attracting attention globally as the third closest immune checkpoint inhibitor target after PD-(L)1 and CTLA-4.

Like PD-1, LAG-3 is an inhibitory immune checkpoint inhibitor expressed by T cells, and the mechanism of action of LAG-3 has not yet been fully elucidated. However, it is a well-known ligand that binds to MHC II of cancer cells and inhibits the apoptosis of T cells, and other ligands such as galectin-3 have recently been discovered. However, it is being developed based on the results of activating T cells and observing synergy in efficacy when PD-(L)1 and LAG-3 are inhibited in preclinical tests.

CEO Lee said, "LAG-3 still has a lot of mechanics that still need to be elucidated. Nevertheless, LAG-3 is one of the inhibitory immune checkpoint inhibitors whose expression increases in patients who do not respond to with PD-(L)1 immune checkpoint inhibitors, and when analyzing patient samples, LAG-3 expression is high when PD-L1 is overexpressed. In other words, it shows a similar pattern to expression. We can expect higher efficacy by targeting the two factors together."

This approach has been clinically proven. Last year, BMS announced the results of increasing the progression-free survival (PFS), the primary endpoint, in phase 3 clinical trials comparing 'relatlimab' and Opdivo combination or Opdivo alone as the first-line treatment for metastatic melanoma patients (HR=0.75). Overall survival (OS) results are still being tracked. The benefit of the PFS index was similar to that reported in the previous Yervoy and Opdivo combination treatment clinical trials, and the grade 3 or higher adverse effects were only half. Based on the results, BMS has submitted an application for new drug approval (IND) to the FDA, and a final decision on whether to market will be decided by the 22nd of next month.

ABL Bio is expected to overcome existing PD-(L)1 drug resistance by simultaneously inhibiting LAG-3 and PD-L1 with a bispecific antibody. ABL Bio's bispecific antibody ABL501 is a '2+2' form in which two PD-L1 scFvs are attached to the Fc part of the LAG-3 antibody, and it is designed to have high binding affinity to LAG-3 based on the fact that the PD-(L)1 antibody has a certain affinity from the results of preclinical phase. ABL Bio confirmed the data that led to higher anticancer activity compared to the combination of PD-L1 and LAG-3 and PD-L1 alone.

ABL Bio started the domestic phase 1 clinical trial of ABL501 in patients with metastatic solid cancer in October last year, and the clinical trial is expected to be completed in the second half of this year (NCT05101109). ABL501 has been selected as a new drug clinical development project by the Korea Drug Development Fund (KDDF) since November last year, and will receive funding for phase 1 clinical research and development for two years with the goal of applying for IND in phase 2 clinical trials next year.

CEO Lee said, "The expression of LAG-3 has been actually observed in blood cancers and solid cancers, and it is an idea to overcome the refractory response of immune checkpoint inhibitors. We are proceeding with a strategy to go to global clinical trials by confirming drug safety and appropriate dosage in domestic clinical trials,” he added.

◆ ‘Portfolio diversification’... What is the direction of development of next-generation immunotherapy?

Another keyword in ABL Bio's portfolio is 'diversification'. ABL Bio is building a next-generation portfolio from multiple perspectives while building a 4-1BB bispecific antibody platform in its immuno-oncology portfolio.

As a first step, ABL Bio unveiled its first acute myelogenous leukemia (AML) candidate CLL-1xCD3 bispecific antibody "ABL602" at the American Society for Hematology (ASH) last year. ABL602 is a bispecific antibody that binds ‘2+1’ to cancer antigen and CD3, respectively, while lowering the binding affinity to CD3 to reduce the adverse effects of the CD3 bispecific antibody. In preclinical studies, ABL602 showed more specific efficacy in killing cancer cells expressing CLL-1 compared to the competing drug '1+1' format bispecific antibody. The possibility of lowering the adverse effects of CRS was confirmed due to low secretion of cytokines such as TNF-α or IL-6.

CEO Lee said, "Recently, data showing the possibility of surpassing CAR-T in next-generation CD3 bispecific antibody clinical trials have been released. By expanding the portfolio of various hypotheses and strategies, we can attempt for co-administration of our own 4-1BB bispecific antibodies."

ABL Bio's portfolio is not limited to T-cell engagers. It is judged that there is sufficient competitiveness If a differentiated asset can be created by applying the immuno-oncology target, which is producing meaningful clinical results, to the bispecific antibody.

Regarding the direction of ABL Bio’s immuno-oncology assets in the future, CEO Sang-Hoon Lee said, “We are expanding the existing 4-1BB platform or discovering new immune checkpoint inhibitor bispecific antibodies, etc. And we are focusing on bispecific antibodies that target immunosuppressive myeloid cells in the tumor-microenvironment (TME) as a next-generation immune-cancer drug following T cells.”

관련기사

- The 4 meanings of the ABL-Sanofi’s $10.6B deal, Comparing with big deals in K...

- Sanofi pays ABL Bio $75M to jump into α-synuclein race, betting on best-in-cl...

- ABL Bio, unveil 'BBB shuttle antibody targeting α-Syn' preclinical data at AD...

- '터닝포인트' 에이비엘, T세포 engager "자신 이유"

- 이상훈 대표, “이중항체 병용투여 시대 오고있다”